Your bank account is a reflection of your mindset. Learn how to shift from scarcity to abundance and master the psychology of money to reach your goals faster.

The FHSA offers a powerful tax deduction now and tax-free withdrawals later. Learn the contribution limits, eligibility rules, and how it beats the RRSP and TFSA for your first home.

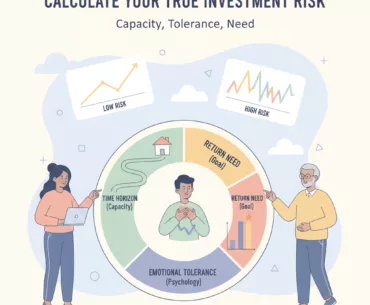

Stop relying on generic quizzes. Learn the 3 pillars of true investment risk: Capacity, Tolerance, and Need. A simple guide for Canadian investors.

Meta Description (1–2 sentences): Struggling to decide whether to pay off high-interest debt or invest in your TFSA or RRSP? This guide breaks down the math and the psychology behind the debt vs investment dilemma for Canadians.

Stop overcomplicating your portfolio. Discover how Canadian All-in-One ETFs (like VEQT, XGRO, and ZBAL) allow you to own the world with a single purchase.

Confused by stocks vs. bonds vs. cash? This simple guide for Canadian investors explains what each one does, how they work together, and how to use them in your TFSA and RRSP.