When it comes to building wealth, few concepts are as powerful and as misunderstood as compound interest. Albert Einstein reportedly called it the eighth wonder of the world. Whether you’re saving for retirement, a home, or simply want your money to grow over time, compound interest can turn small, consistent contributions into substantial long-term wealth.

This guide explains what compound interest is, how it works, and why Canadians should start using it to their advantage today.

What Is Compound Interest?

At its core, compound interest is the process of earning interest not only on your original investment (the principal), but also on the interest that accumulates over time. It’s interest on interest and that’s where the magic happens.

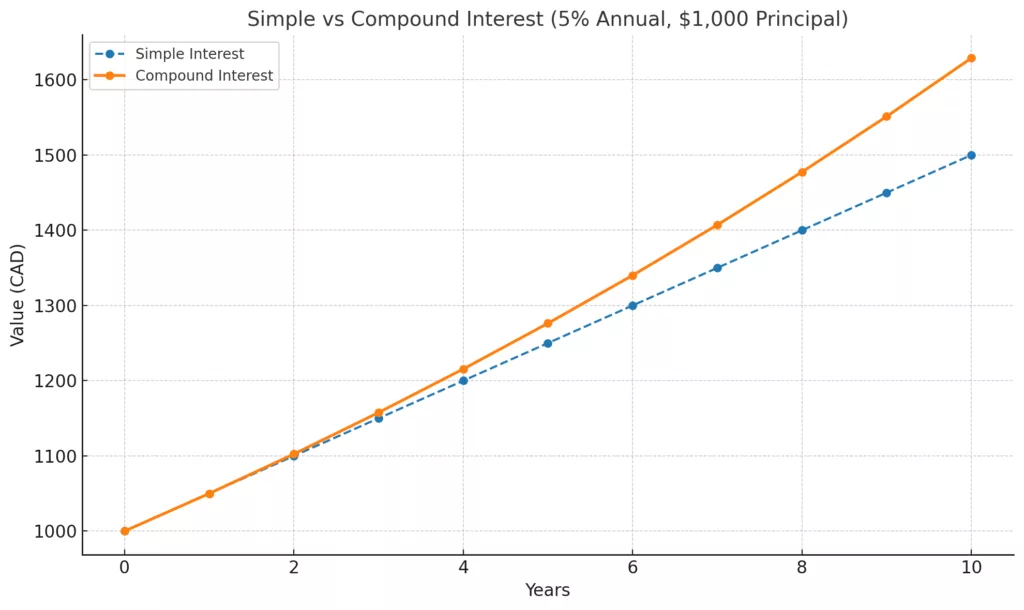

Simple Interest Example:

- You invest $1,000 at 5% simple interest per year.

- After 10 years, you have $1,500.

Compound Interest Example:

- You invest $1,000 at 5% interest, compounded annually.

- After 10 years, you have $1,628.89.

- That extra $128.89 is money earned on your interest.

Why Compound Interest Matters for Canadians

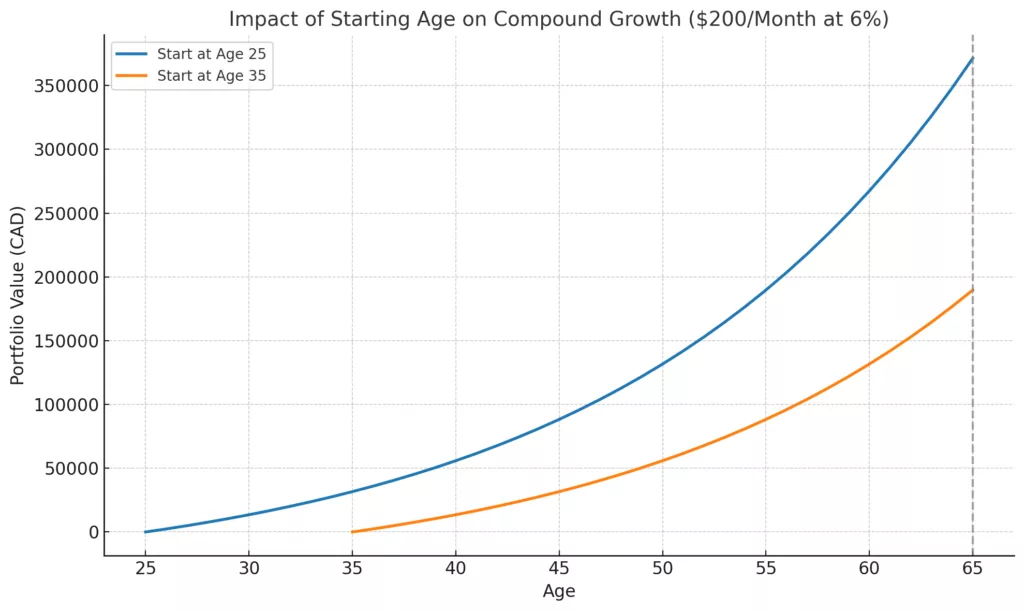

1. Time Is Your Best Friend

The earlier you start, the more time compound interest has to work. Even small amounts can grow significantly.

Example:

- If you invest $200 a month at 6% starting at age 25, you’ll have about $400,000 by age 65.

- If you wait until age 35 to start, you’ll end up with only $200,000 by age 65 despite investing the same $200/month.

That 10-year head start doubles your outcome.

2. Works Well With Canadian Accounts (TFSA & RRSP)

Compound interest is even more powerful when sheltered from taxes:

- TFSA – All growth and withdrawals are tax-free. Perfect for both short- and long-term goals.

- RRSP – Contributions reduce your taxable income, and investments grow tax-deferred until retirement.

By combining compound growth with tax-advantaged accounts, Canadians can accelerate wealth building significantly.

3. It Encourages Consistency

Investing consistently even small amounts matters more than timing the market. Regular contributions harness the power of compounding automatically.

Tip: Set up an automatic transfer to your TFSA or RRSP each payday. This removes the guesswork and helps you stay disciplined.

How Compound Interest Works in Real Life

To see how compound growth can shape your wealth, let’s compare two very different Canadian investment approaches.

- Scenario A: You invest $500/month in iShares Core Equity ETF Portfolio (XEQT), which is 100% equities, averaging about 7% annual growth over the long term.

- After 30 years, your total contributions are $180,000.

- Thanks to compound interest, your portfolio grows to nearly $600,000.

- Scenario B: You invest the same $500/month in Global X High Interest Savings ETF (CASH.TO), which offers about 5% yield today (variable over time).

- After 30 years, your total contributions are still $180,000.

- Your balance grows to about $340,000.

Important Warning: Different Tools, Different Goals

While it’s tempting to look at these numbers and conclude that XEQT is “better,” it’s crucial to remember:

- XEQT (100% equities) is designed for long-term growth and comes with significant short-term volatility. Its returns are not guaranteed, and market downturns can temporarily reduce your portfolio value. It’s meant for retirement savings or goals 10+ years away.

- CASH.TO (cash ETF) is designed for capital preservation and liquidity. It earns interest like a high-yield savings account, with minimal risk and daily liquidity. It’s ideal for an emergency fund or short-term goals (like buying a home in 1–3 years).

Both can use compound interest to grow, but the context matters: one prioritizes growth, the other safety.

Tips to Maximize Compound Interest

- Start Early – The best time to start was yesterday. The second-best time is today.

- Invest Regularly – Automate contributions to remove hesitation.

- Keep Costs Low – Use low-fee index funds and ETFs. High fees eat into compounding.

- Reinvest Dividends – Don’t take payouts as cash. Reinvest them to maximize growth.

- Be Patient – Compounding rewards time, not quick wins.

Common Mistakes to Avoid

- Waiting too long – Procrastination is the enemy of compounding.

- Cashing out early – Interrupting growth can significantly reduce your results.

- Ignoring fees and taxes – MERs, trading fees, and taxes can erode gains if not managed.

- Overreacting to market swings – Stay the course; consistency beats panic selling.

Final Thoughts

Compound interest is the quiet engine behind long-term wealth. It rewards patience, consistency, and time. Whether you’re investing through your TFSA, RRSP, or even a RESP for your child’s education, understanding compound interest is one of the most valuable financial lessons you can learn.

The earlier you start, the bigger the impact. Even if you can only save a small amount today, let compounding work its magic and your future self will thank you.